What does my payslip mean?

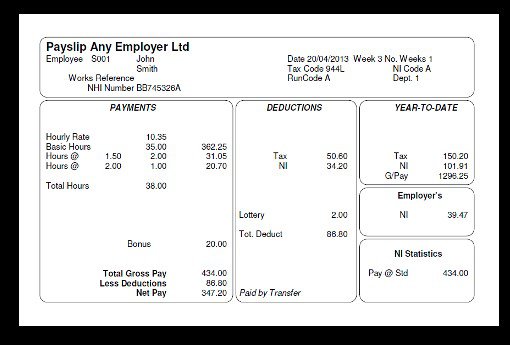

Every employee is entitled to receive a payslip each time they're paid - but you might find that no one ever sits you down to explain what it all means. It's no surprise then that so many of us don't fully understand them. Whether you're paid on a monthly, weekly or bi-weekly basis, your payslip is an opportunity to look over a summary of all your earnings and deductions after you're taxed for things like National Insurance, pay into your pension pot, or a bit of your student loan.

We've put together a glossary of terms to help you understand your payslip, so you feel more confident about where your money is going and how much you have access to to spend on bills, add to savings or yourself.

Glossary of payslip terms and phrases

We can help you unpack the terms found on your payslip in our handy glossary. We hope you will feel more confident about keeping track of your earnings each month and be able to make a budget based on the money you take home after the other payments have been deducted.

When you take a look at your payslip, you'll notice some of the following financial terms. Have a look to see if you recognise some of the phrases that appear before you read on to see our helpful definitions for each of them:

- Fixed deductions means the money deducted from your wage such as union fees. These are a fixed amount of money.

- Gross pay is the full amount you are paid before any money is deducted for tax and other mandatory payments.

- Net pay is the amount of money you ‘take home’. The amount you’re left with after tax and other payments have been deducted.

- Pension contribution is the money you may have chosen to pay into an optional pension scheme and will also be shown on your payslip as a deduction.

- Student loan if you’re making repayments on a student loan this will also be shown as a deduction on your payslip.

- Variable deductions refers to the money deducted from your wage, for example the tax you pay on your income or National Insurance Contributions. These can change from pay day to pay day.

Income tax

Income tax is an amount of money deducted from your pay. There are different levels of tax for different levels of earning. Some income is tax free. The money deducted goes to the government.

Read more about income tax levels on the government website.

National Insurance Contributions (NICs)

An amount of money deducted from your pay so you qualify for benefits such as the State Pension. There are different classes of NIC depending on how much you earn. The money deducted goes to the government.

Check the government website to read more about NIC classes.

What National Insurance will I pay?

There are four main classes of National Insurance:

- Class one is paid by employees and employers

- Class two is paid if you’re self-employed

- Class three is a voluntary contribution

- Class four is paid if you’re self-employed and have profits over a certain amount.

If you are an employee you start paying National Insurance when you earn more than £242 a week. As of the end of 2022, the rate you pay depends on how much you earn:

- 13.25% of your weekly earnings between £242 and £967

- 3.25% of your weekly earnings above £967.

What is PAYE on a payslip?

Pay As You Earn is a method used by employers for deducting income tax and National Insurance Contributions. Your employer will automatically deduct income tax and National Insurance Contributions before paying your wage.

How much PAYE should I earn?

Depending on your annual income, you will be charged either 20% (basic rate), 40% (higher rate) or 45% (additional rate tax band) of your earnings.

Pension

A pension scheme is a type of savings plan to help you save money for later in life. A small amount of money is deducted from your pay cheque and put in a savings pot which you can then access when you retire. All pension schemes are optional.

Self-assessment

If you are a freelancer you may be responsible for your own tax and NICs. This is called ‘self-assessment’. This means you need to submit records of your income to HMRC and they will calculate how much you owe. HMRC is Her Majesty’s Revenue and Customs, the government department concerned with taxes.